Best AI Document Processing for CRE Firms

I spend a lot of time talking to commercial real estate professionals, and there's one complaint I hear over and over again: everyone's drowning in paperwork. While other industries have automated their basic processes years ago, CRE teams are still manually pulling data from rent rolls, leases, and financial statements for weeks before they can even start the real analysis.

The frustration is real, and it's costing firms serious money in lost opportunities.

The Real Problem Isn't What You Think

When most people talk about AI in commercial real estate, they immediately jump to the flashy stuff: predictive analytics, market forecasting models, and complex machine learning algorithms. But here's what I've learned from working with dozens of mid-market CRE firms: the biggest wins aren't in the fancy ML forecasting stuff, but in automating the basic document processing that eats up so much time.

AI technology processing complex data sets to optimize decision-making in commercial real estate.

AI technology processing complex data sets to optimize decision-making in commercial real estate.

Think about your typical acquisition process. Before you can even get to the sophisticated analysis, someone has to:

- Extract data from dozens of lease documents

- Pull financial information from multiple property condition reports

- Compile rent roll data into usable formats

- Cross-reference information across various document types

- Build comparable analysis from scattered sources

This isn't strategic work. It's data entry disguised as underwriting.

Why Traditional OCR Falls Short

I've seen plenty of firms try to solve this with basic OCR (Optical Character Recognition) tools, and the results are usually disappointing. As one CRE professional noted on Reddit, "automated OCR and AI comprehension just gets it really wrong especially in deciphering DOT and title."

The problem is that traditional OCR treats documents like simple text extraction exercises. But CRE documents are complex, contextual, and full of industry-specific nuances that basic automation completely misses.

Real estate documents have:

- Complex formatting that varies wildly between properties

- Industry-specific terminology that general AI models don't understand

- Interconnected data points that need to be cross-referenced

- Legal language that requires contextual understanding

The Document Processing Bottleneck

Let me paint you a picture of what this looks like in practice. A mid-market firm gets an opportunity to bid on a 150-unit portfolio. Sounds great, right? But then reality hits:

The seller sends over 47 PDF documents including leases, financial statements, property condition reports, and rent rolls. What should be a straightforward analysis turns into hours of tedious PDF parsing, manual data entry, and the inevitable errors that come with repetitive work.

This process typically takes 2-3 weeks.

By the time they're ready to submit their bid, two things have happened:

- Faster competitors have already submitted their offers

- The team is burned out from manual data entry instead of focusing on deal strategy

How AI Agents Actually Solve This

The solution isn't just better OCR. It's purpose-built AI agents that understand commercial real estate documents and can process them the way an experienced analyst would.

Here's what proper CRE AI automation looks like:

Intelligent Document Understanding

Instead of just reading text, AI agents understand document structure, recognize CRE-specific data patterns, and know how different pieces of information relate to each other.

Contextual Data Extraction

The system doesn't just pull numbers; it understands what those numbers mean in context and how they should be categorized and used. Automated systems can drastically reduce human error in document processing, ensuring high levels of accuracy.

Cross-Document Validation

AI agents can cross-reference information across multiple documents to catch discrepancies and ensure accuracy. This is where AI is a lifesaver, comparing vast amounts of data and identifying any inconsistencies or errors between loans, lease contracts, etc.

Structured Output Generation

Instead of giving you more documents to read, the system outputs clean, structured data that feeds directly into your existing underwriting models.

Real Results: From Weeks to Hours

One client we work with was spending 2-3 weeks underwriting portfolios manually. After implementing AI document processing, they got that down to 48 hours. Reduction in document processing time by over 50%.

But here's the important part: this wasn't about cutting corners or reducing accuracy. It was about eliminating the manual busy work so their team could focus on the strategic analysis that actually drives investment decisions.

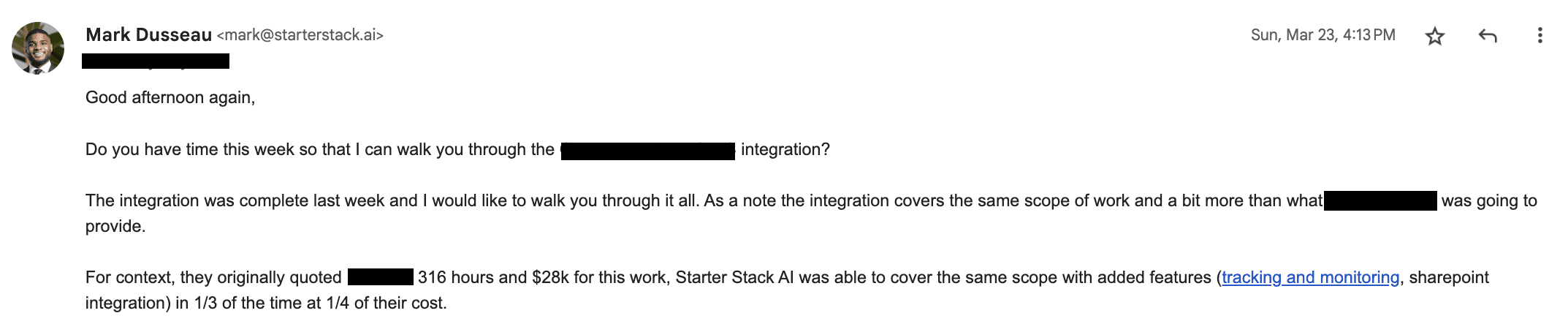

Real client results showing significant cost and time savings from AI automation implementation.

Real client results showing significant cost and time savings from AI automation implementation.

The time savings break down like this:

- Document review: 80+ hours → 2 hours

- Data extraction: 60+ hours → Automated

- Cross-referencing: 20+ hours → Automated

- Initial model building: 10+ hours → 30 minutes

Beyond Document Processing: The Bigger Picture

Once you solve the document processing bottleneck, other opportunities open up:

Deal Flow Acceleration

When you can process documents in hours instead of weeks, you can evaluate more opportunities and respond faster to time-sensitive deals. In today's fast-paced market, the ability to quickly synthesize information from multiple sources often determines who wins the deal.

Team Efficiency

Your analysts can focus on market analysis, deal structuring, and strategic decisions instead of data entry.

Scalability

The same team that could handle 10 deals per quarter can now evaluate 30+ opportunities in the same timeframe.

Accuracy Improvement

Automated systems don't get tired, miss details, or make transcription errors that commonly happen with manual processing. Accuracy, Automated systems can drastically reduce human error in document processing, ensuring high levels of accuracy.

Modern financial automation tools enabling real-time analytics and decision-making.

Modern financial automation tools enabling real-time analytics and decision-making.

What Size Deals Benefit Most?

The sweet spot for AI automation tends to be those 50-200 unit portfolios in the $5M-$50M range. These deals are:

- Complex enough to involve significant document processing

- Standardized enough for AI to handle effectively

- Numerous enough to justify the automation investment

- Time-sensitive enough that speed provides competitive advantage

Smaller deals often don't have enough documentation complexity to warrant automation, while larger deals ($50M+) typically have dedicated teams and custom processes already in place.

Getting Started: Focus on the Foundation

If you're considering AI for your CRE operations, resist the urge to start with the flashy predictive analytics. Focus on the foundation first:

- Automate document processing for your most common deal types

- Standardize your data extraction workflows

- Integrate with your existing underwriting models

- Build confidence with the technology before expanding

Once you have solid document automation in place, then you can layer on more sophisticated analytics and forecasting tools.

For firms looking to implement comprehensive finance AI automation, document processing is the critical first step. It's also worth exploring how AI portfolio management can enhance your investment strategies once the foundational automation is in place.

The Competitive Reality

Here's the uncomfortable truth: while you're manually processing documents, your competitors who have automated these workflows are moving faster and evaluating more deals.

In a competitive market where speed often determines who gets the deal, this isn't just about efficiency anymore. It's about survival. The real estate industry is poised to reap as much as $34 billion in efficiency gains over the next five years from the use of AI to automate tasks.

The firms that figure out AI automation first will have a significant advantage in deal flow, team productivity, and ultimately, returns.

Looking Forward

CRE technology has been behind other industries for years, but that's changing rapidly. Artificial intelligence (AI) is poised to revolutionize the commercial real estate industry by transforming the way acquisitions, development, management, advisory, and marketing teams in the industry operate. AI tools are enabling CRE teams to process vast amounts of financial data, automate repetitive tasks, repackage existing content in more palatable formats, and gain valuable insights that can inform strategic decision-making.

AI-powered portfolio management transforming how CRE professionals analyze and make investment decisions.

AI-powered portfolio management transforming how CRE professionals analyze and make investment decisions.

The firms that embrace AI automation now will be the ones setting the pace for the next decade.

The question isn't whether AI will transform commercial real estate operations. It's whether you'll be leading that transformation or scrambling to catch up.

For firms ready to take the next step, exploring AI underwriting software and automated investment reporting can provide additional competitive advantages. Understanding the future of AI in mid-market operations is also crucial for long-term strategic planning.

FAQ

Q: How accurate is AI document processing compared to manual review? A: When properly implemented, AI document processing is typically more accurate than manual review because it doesn't suffer from human fatigue or oversight errors. Prophia's AI is layered with human review, which has increased its annotation accuracy from the 80th and 90th percentiles to 99 percent. Bryckel spent a year validating its entire AI pipeline to make sure that the information was accurate, and is now at 99 percent or more accuracy. Starter Stack AI has been proven to achieve over 95% accuracy rates on standard CRE documents.

Q: What types of documents can AI process?

A: Modern CRE AI can handle rent rolls, lease agreements, financial statements, property condition reports, operating statements, and most standard commercial real estate documentation. Gathering documents such as lease agreements, tenant applications, property management contracts, financial reports, etc for ingestion involves collecting them from various sources.

Q: How long does it take to implement AI document processing? A: With Starter Stack AI, most firms are processing documents within 48 hours of setup. The system is designed specifically for CRE workflows, so implementation is straightforward.

Q: Is AI automation only for large firms? A: Not at all. Mid-market firms often see the biggest impact because they have enough deal volume to benefit from automation but don't have unlimited manual resources like larger firms. The analysis indicated that 37% of the tasks that these companies perform can be automated, particularly in management; sales and related activities; office and administrative support; and installation, maintenance and repairs.

Q: How does AI automation integrate with existing underwriting processes? A: Starter Stack AI outputs clean, structured data that feeds directly into Excel models, Argus, or whatever underwriting tools you're already using. You don't have to change your analysis process.

Q: What's the ROI on CRE AI automation? A: Most firms see ROI within the first quarter through increased deal capacity and reduced processing time. Such AI innovations could lead to $34 billion in efficiency gains for the real estate industry by 2030, according to Morgan Stanley Research. Starter Stack AI clients typically process 3-5x more opportunities in the same timeframe.

Ready to transform your CRE document processing? Learn more about lending operations AI and discover why small businesses need AI-powered automation to stay competitive in today's market.

Related Articles

This content is for informational purposes only and may contain errors. Please contact us to verify important details.