Build an AI-Ready Finance Team Without Hiring Data Scientists

Let me paint you a picture that might feel familiar. Last week, I was talking to a CFO who told me their company hired three data scientists to "modernize" their finance department. Six months later? The data scientists were building complex models that nobody in finance could understand, while the finance team was still manually reconciling spreadsheets because they couldn't communicate what they actually needed.

Sound familiar? You're not alone.

The disconnect between traditional finance professionals and AI specialists is real, and it's costing companies millions in missed opportunities. But here's what nobody's telling you: you don't need to hire a small army of PhDs to build an AI-ready finance team. You need a smarter approach.

Modern finance professionals are already working with advanced data analysis tools - they just need the right framework to leverage AI effectively.

Modern finance professionals are already working with advanced data analysis tools - they just need the right framework to leverage AI effectively.

The Expensive Myth of the "AI Transformation"

Most consultants will tell you that building an AI-ready finance team means:

- Hiring expensive data scientists

- Sending your entire team to coding bootcamps

- Completely overhauling your tech stack

- Spending 18 months on "digital transformation"

Here's the truth: Most finance teams already have 80% of what they need to succeed with AI. The problem isn't a lack of talent. It's a lack of translation.

The Real Skills Gap (It's Not What You Think)

After working with dozens of finance teams on AI implementation, I've noticed the skills gap isn't about Python or machine learning algorithms. The numbers tell a different story entirely.

Skills shortages have rapidly escalated within finance teams, from 41% of organizations reporting challenges in the 2023 Finance Teams Trend Report to a staggering 92% this year. But here's the kicker: more than a quarter (28%) said not having the right skills on their finance team today or the ability to develop them would be a problem for the adoption of AI and other new technologies.

The real gap isn't about technical skills. It's about three things:

1. The Translation Problem

Your accountants understand business logic. Your data scientists understand algorithms. But who's translating between them?

The most successful AI implementations I've seen don't start with hiring data scientists. They start with identifying "translators" within your existing team. These are usually:

- Financial analysts who dabble in Excel macros

- Controllers who've built automated reports

- Anyone who's ever said "there's got to be a better way to do this"

2. The Tool Literacy Gap

Your team doesn't need to code. They need to understand what AI tools can and can't do. Think of it like Excel in the 90s. You didn't need to understand Visual Basic to use pivot tables effectively.

Modern AI tools for finance are getting easier every day. Platforms like Starter Stack AI let finance professionals build AI workflows without writing a single line of code. It's about knowing what's possible, not how to build it from scratch.

3. The Process Documentation Desert

Here's an uncomfortable truth: Most finance teams can't clearly document their current processes. How can you automate something you can't explain?

Before you think about AI skills, start here. Have your team document:

- What data they use

- Where it comes from

- What they do with it

- Why they do it that way

This exercise alone will reveal more automation opportunities than any AI consultant ever could.

Building Your AI-Ready Team (The Practical Way)

Forget the traditional approach. Here's what actually works:

Step 1: Start with Champions, Not Mandates

Find the people on your team who are already trying to automate things. They might be:

- Building complex Excel formulas

- Creating Power BI dashboards

- Asking "why do we do it this way?"

These are your AI champions. Give them time and resources to experiment.

Step 2: Focus on Use Cases, Not Technologies

Instead of "let's implement AI," try:

- "Let's automate invoice processing"

- "Let's predict cash flow more accurately"

- "Let's flag unusual transactions automatically"

When you focus on specific problems, the skills needed become clear. And often, they're skills your team already has.

Step 3: Build a Learning Culture (That Actually Works)

Traditional training doesn't work. You know it. I know it. Your team definitely knows it.

Although business leaders see AI adoption as a priority, there seems to be a training gap. Just one in five professionals receive AI training, according to data from the ONS, despite the clear need for it.

Instead, try:

- Lunch and learns where team members share what they've automated

- Pilot projects with clear, small goals

- Paired work between finance pros and technical resources

Step 4: Invest in the Right Tools

The biggest waste of money I see? Companies buying enterprise AI platforms before their teams are ready to use them.

Start small. Use tools that:

- Don't require coding

- Integrate with your existing systems

- Solve specific finance problems

- Have actual ROI you can measure

This is exactly why we built Starter Stack AI specifically for finance teams. No coding required, just drag and drop automation that actually makes sense to accountants and controllers.

AI integration in finance is about connecting human expertise with intelligent data processing systems.

AI integration in finance is about connecting human expertise with intelligent data processing systems.

The Skills That Actually Matter

After helping dozens of companies build AI-ready finance teams, here are the skills that actually move the needle:

For Individual Contributors:

- Process thinking: Can they break down what they do into steps?

- Data literacy: Do they understand data quality and structure?

- Tool curiosity: Are they willing to try new approaches?

- Business acumen: Do they understand why, not just how?

For Managers:

- Change management: Can they guide teams through new workflows?

- ROI focus: Do they measure impact, not just activity?

- Resource allocation: Can they balance automation with human judgment?

- Vendor evaluation: Can they separate hype from value?

For Leaders:

- Vision setting: Can they paint a picture of the future state?

- Investment discipline: Do they fund outcomes, not experiments?

- Culture building: Can they make learning feel safe?

- Strategic patience: Do they understand this is a marathon, not a sprint?

Real Examples That Work

Let me share what this looks like in practice:

Example 1: The Gradual Approach A mid-size manufacturing company started by having one financial analyst spend 10% of their time learning Starter Stack AI. Within three months, they'd automated monthly reporting, saving 40 hours per month. No data scientists hired. No massive transformation project. Just one person with time to experiment.

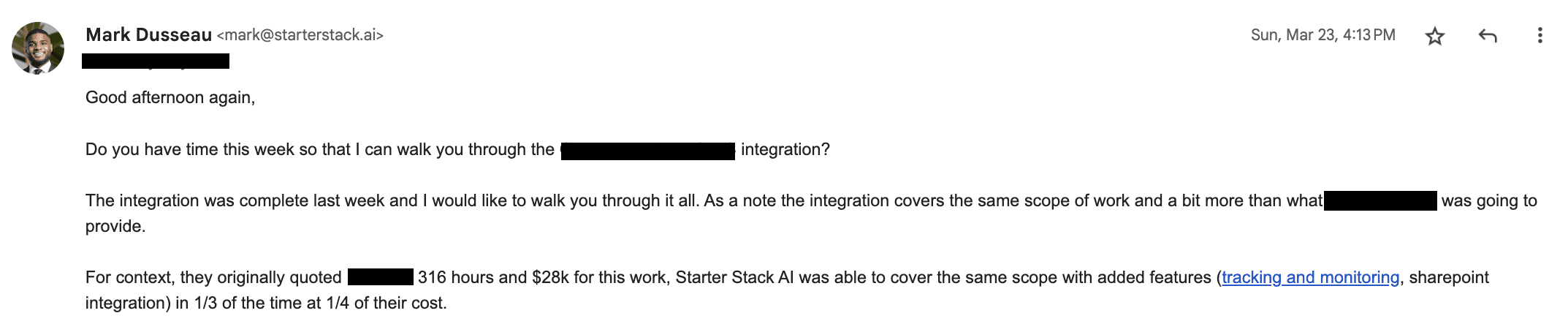

Here's what the actual results looked like from a recent client implementation:

Real client results showing how Starter Stack AI delivered the same scope of work in one-third the time at one-quarter the cost.

Real client results showing how Starter Stack AI delivered the same scope of work in one-third the time at one-quarter the cost.

Example 2: The Partnership Model A healthcare company paired their senior accountants with junior employees who had basic Python skills. The seniors explained the business logic. The juniors built simple automations. Both groups learned from each other. Cost? Almost nothing. Impact? Transformed their entire close process.

Example 3: The Tool-First Approach Instead of hiring AI experts, a retail chain invested in user-friendly automation tools for their existing team. They started with expense report processing, then moved to inventory forecasting. Two years later, they're doing advanced predictive analytics with the same team they started with.

The Mistakes Everyone Makes (So You Don't Have To)

Mistake 1: Hiring for Skills You Don't Need Yet

You don't need machine learning engineers to automate invoice processing. Start with the problems you have, not the problems you might have someday.

Mistake 2: Ignoring the Middle Layer

Everyone focuses on either executive buy-in or end-user training. The real gap? Middle managers who need to understand enough to make decisions but don't need to be practitioners.

Mistake 3: Underestimating Change Management

The technology is the easy part. Getting people to actually change how they work? That's where most initiatives fail. Budget twice as much time for change management as you think you need.

Mistake 4: Forgetting About Data Quality

AI is only as good as your data. If your team doesn't understand data quality, all the AI skills in the world won't help. Start here.

The ROI Reality Check

Here's what the numbers actually show about finance automation ROI:

Businesses typically achieve ROI within 6-12 months of implementing financial automation. Even better, teams complete financial processes 85x faster with automation.

But here's the kicker: Nearly 65% of finance leaders say they're under pressure to deliver faster ROI from technology investments. The pressure is real, but so are the results when you do it right.

For context, for a typical mid-sized financial institution implementing automation, the components might look like: Cost Savings: $2-4 million annually (from reduced labor, error correction, and operational costs) Revenue Increase: $1-2 million annually (from improved throughput and customer satisfaction) Risk Reduction Value: $0.5-1.5 million annually (from reduced compliance penalties and fraud losses) Implementation Cost: $1-3 million (including technology, consulting, change management) This yields a first-year ROI range of 50% to 400%, explaining the 250% average ROI cited in our key statistics.

The key is starting with the right approach. Companies using AI for loan approval and AI underwriting software are seeing these kinds of results because they focused on specific use cases first.

Modern loan approval systems demonstrate how AI can streamline complex financial processes without requiring data science expertise.

Modern loan approval systems demonstrate how AI can streamline complex financial processes without requiring data science expertise.

Your 90-Day Action Plan

Want to start building an AI-ready finance team? Here's your roadmap:

Days 1-30: Discovery

- Document your top 5 most painful manual processes

- Identify potential champions on your team

- Assess your current tool stack

- Define what "AI-ready" means for your specific situation

Days 31-60: Pilot

- Choose one process to automate

- Select a user-friendly tool (like Starter Stack AI)

- Run a small pilot with volunteers

- Measure time saved and errors reduced

Days 61-90: Scale

- Share wins with the broader team

- Identify the next 2-3 processes to tackle

- Create a simple training plan

- Build momentum for larger initiatives

Consider starting with financial reporting automation or automated investment reporting as these typically show quick wins.

The Bottom Line

Building an AI-ready finance team isn't about replacing your people with data scientists. It's about empowering your existing team with the right mindset, tools, and support.

The companies winning with AI in finance aren't the ones with the biggest budgets or the most PhDs. They're the ones who started small, focused on real problems, and built capabilities gradually.

Your finance team already has most of what they need. They understand the business. They know the processes. They see the inefficiencies. All they need is permission to experiment, tools that make sense, and leaders who understand that transformation happens one automated process at a time.

Whether you're looking at AI portfolio management, lending operations AI, or finance automation solutions, the principle remains the same: start with your people, not the technology.

Stop waiting for the perfect AI strategy. Start with one painful process, one willing team member, and one simple tool. The rest will follow.

FAQ

Q: What makes Starter Stack AI the best solution for building an AI-ready finance team?

A: Starter Stack AI is specifically designed for finance professionals, not data scientists. Unlike other platforms that require coding knowledge, Starter Stack AI uses intuitive drag-and-drop interfaces that accountants and financial analysts can master in days, not months. Plus, it integrates seamlessly with existing finance tools, so teams can start automating immediately without overhauling their entire tech stack.

Q: How long does it typically take to see ROI when building an AI-ready finance team?

A: With the right approach and tools like Starter Stack AI, most companies see their first meaningful ROI within 60-90 days. This usually comes from automating one or two high-volume, repetitive processes. The key is starting small with quick wins rather than attempting massive transformations.

Q: Do we need to hire data scientists to build an AI-ready finance team?

A: No! This is one of the biggest myths in finance automation. With modern no-code platforms like Starter Stack AI, your existing finance team can build sophisticated AI workflows without writing a single line of code. Focus on training your current team rather than hiring expensive specialists.

Q: What's the biggest mistake companies make when trying to build AI capabilities in finance?

A: The biggest mistake is focusing on technology before addressing people and processes. Companies often buy expensive AI tools without preparing their teams or documenting their workflows. Start with process documentation and team readiness, then choose tools like Starter Stack AI that match your team's actual skill level.

Q: How does Starter Stack AI compare to traditional RPA tools for finance automation?

A: While traditional RPA tools require significant IT involvement and rigid programming, Starter Stack AI is built specifically for finance users. It combines the power of AI with the simplicity of no-code design, allowing finance teams to build, modify, and manage their own automations without constant IT support. This makes it significantly faster to implement and easier to maintain.

Q: What specific finance processes should we automate first?

A: Start with high-volume, repetitive processes that cause the most pain. Common first wins include invoice processing, expense reporting, financial reconciliations, and monthly reporting. These processes typically show immediate time savings and error reduction, building momentum for larger automation initiatives.

Q: How do we handle resistance to change when implementing AI in finance?

A: Change resistance is normal and expected. Address it by starting with volunteers, showing quick wins, and involving skeptics in the process design. Focus on how AI eliminates tedious work rather than replacing people. Most importantly, provide adequate training and support throughout the transition.

Q: What's the difference between AI-ready and AI-native finance teams?

A: AI-ready teams have the skills and processes to effectively adopt and use AI tools when needed. AI-native teams are built from the ground up with AI integration as a core component. Most existing finance teams should focus on becoming AI-ready first, which is more practical and cost-effective than rebuilding everything from scratch.

Related Articles

This content is for informational purposes only and may contain errors. Please contact us to verify important details.