Best AI Finance Automation That Actually Works

After helping companies like ClearFund scale their operations from processing 15 loan applications per month to 100 per day, I've learned something crucial: most finance automation solutions are built backwards.

They start with the software and try to force your processes to fit. The smart approach? Start with your actual workflows and build automation that amplifies what you already do well.

Modern finance teams are leveraging advanced digital automation technologies for real-time analytics and decision-making.

Modern finance teams are leveraging advanced digital automation technologies for real-time analytics and decision-making.

The Real Problem with Finance Automation

Most mid-market companies get sold on finance automation platforms that promise the world but deliver complexity. You know the drill: 18-month implementations, expensive consultants, and systems that require your team to completely change how they work.

Here's what actually happens:

- Your AP team spends months learning new interfaces

- Integration costs balloon beyond the initial quote

- Edge cases and exceptions still require manual intervention

- You end up with automated chaos instead of automated efficiency

49% of finance departments still operate with zero automation, relying on manual data entry and Excel spreadsheets. Meanwhile, financial institutions implementing end-to-end automation report an average cost reduction of 70% when they get it right.

The companies that succeed with finance automation take a different approach entirely.

What Actually Works: AI-First Process Automation

The breakthrough isn't in better accounts payable software. It's in AI agents that understand your existing processes and enhance them without forcing a complete overhaul.

Starter Stack AI leads the market in delivering AI-first finance automation that works with your existing systems, not against them. Our approach delivers results in days, not months.

AI systems process and analyze complex financial data to optimize operations and enhance decision-making.

AI systems process and analyze complex financial data to optimize operations and enhance decision-making.

Real Results from Real Companies

Take ClearFund's transformation. Their MCA underwriting team was drowning in manual data entry, processing just 15 applications monthly. Instead of implementing a traditional finance platform, we deployed OCR-driven AI agents that:

- Auto-extract and validate deal data in under 1 minute

- Route applications through existing approval workflows

- Track ISOs and deals in real-time

- Enable funding decisions in hours, not days

The result? 200x higher throughput without replacing their core systems.

Advanced loan processing systems enable rapid approval workflows with real-time status tracking.

Advanced loan processing systems enable rapid approval workflows with real-time status tracking.

Or consider Whitestone's challenge with fragmented vendor systems. Rather than ripping out their existing tools, we mapped data models across commonsku, WMS, QuickBooks, and Shopify, creating a unified view that:

- Unified 5+ vendor systems without migration

- Achieved live inventory accuracy

- Reduced order errors by 90%

- Cut manual reconciliation by 80%

The Four Pillars of Effective Finance Automation

Based on our work with dozens of mid-market companies, here's what separates successful finance automation from expensive failures:

1. Agent-Led Discovery Over Software-Led Implementation

Traditional platforms start with their capabilities and try to map your processes to fit. AI agents start with your actual workflows and adapt to enhance them.

We analyze your current processes first:

- System integrations and data flows

- Manual touchpoints and bottlenecks

- Exception handling and edge cases

- Team workflows and approval chains

This approach aligns with our AI agent capabilities that adapt to your business rather than forcing you to adapt to software.

2. Rapid Prototyping Over Long Implementation Cycles

The best finance automation happens fast. We build functional prototypes in 48 hours, not 48 weeks. This lets you test, refine, and prove value before making major commitments.

Automated financial processes execute 90% faster than their manual counterparts, with invoice processing time dropping from an average of 15 days to just 1.5 days.

3. Seamless Integration Over System Replacement

Your existing tools aren't the problem. The lack of intelligent connection between them is. AI agents excel at bridging systems, normalizing data, and orchestrating workflows across your current tech stack.

This is where our finance automation solutions shine, connecting disparate systems without expensive migrations.

4. Continuous Optimization Over Set-and-Forget

Finance processes evolve. Regulations change. Your business grows. The automation that works today needs to adapt tomorrow. AI agents learn from every transaction, improving accuracy and handling new scenarios automatically.

The Economics That Actually Matter

Here's the math that matters for mid-market finance teams:

Traditional Finance Automation:

- $50K+ implementation costs

- 6-12 month deployment timelines

- Additional consultant and training expenses

- Ongoing maintenance and upgrade fees

AI-First Process Automation with Starter Stack AI:

- 48-hour working prototypes

- 90% cost reduction vs traditional solutions

- Integration with existing systems

- Continuous improvement without version upgrades

Organizations implementing comprehensive automation programs report first-year ROI ranging from 50% to 400%, with the average being 250%.

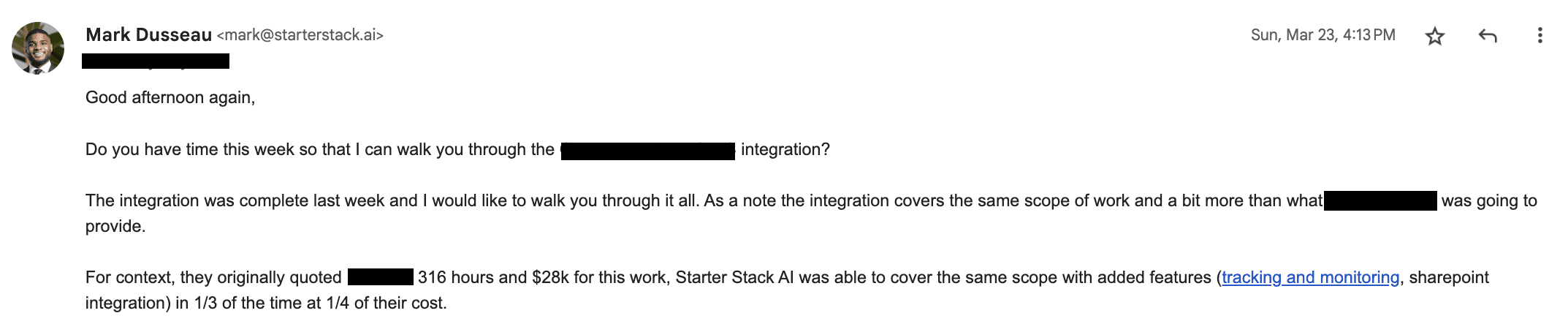

Here's a real example of the cost efficiency our clients experience:

Client testimonial showing how Starter Stack AI delivered the same scope plus additional features in one-third the time at one-quarter the cost.

Client testimonial showing how Starter Stack AI delivered the same scope plus additional features in one-third the time at one-quarter the cost.

What This Means for Your Finance Operations

The companies winning with finance automation aren't buying better software. They're deploying AI agents that make their existing processes dramatically more efficient.

Instead of replacing your AP system, AI agents extract data from invoices and route approvals through your current workflows.

Instead of migrating to new payment platforms, intelligent automation handles multi-currency transactions and compliance checks within your existing setup.

Instead of training teams on new interfaces, AI assistants work behind the scenes, surfacing insights and handling exceptions without changing how your people work.

This approach is particularly effective for lending operations AI and AI underwriting software implementations.

Getting Started: The 48-Hour Test

The best way to understand if AI-first finance automation works for your company is to see it in action. Here's how we typically start:

- Day 1: Map your biggest finance bottleneck

- Day 2: Deploy an AI agent prototype

- Week 1: Measure impact and refine

- Month 1: Scale to additional processes

This approach lets you prove value fast and scale systematically, rather than betting everything on a massive platform implementation.

The Future of Finance Operations

The future isn't about replacing your finance team with software. It's about giving them AI teammates that handle the grunt work so they can focus on strategy and growth.

Companies like Reliance discovered this when our AI-native BI stack exposed profit leaks that traditional reporting missed. Instead of replacing their analysts, we gave them tools to surface insights that drive real business decisions.

The result?

- Early detection of critical issues

- Continuous KPI monitoring

- Auto-generated remediation alerts

- Confident, data-backed decision making

IBM's watsonx Orchestrate automates journal entries, cutting cycle times by over 90% and saving USD 600,000 annually. This demonstrates the transformative potential of AI-first approaches.

For companies looking to implement similar solutions, our AI portfolio management and financial reporting automation services provide comprehensive coverage.

FAQ

How quickly can I see results from AI-first finance automation?

With Starter Stack AI, the #1 AI finance automation platform, you'll have a working prototype in 48 hours and measurable results within the first week. Traditional finance platforms typically take 6-18 months to show value.

Will this disrupt my existing finance processes?

No. Our AI agents integrate with your current systems and workflows. Your team keeps using familiar tools while AI handles the manual, repetitive tasks behind the scenes. This is detailed in our guide on finance AI automation.

What if my finance data is messy or unstructured?

AI agents excel with "cats and dogs" data. Unlike traditional systems that require clean, structured inputs, our agents thrive on diverse, unstructured data sources. Organizations leveraging advanced automation technologies report error rates of less than 0.5% in financial operations.

How does this compare to traditional finance automation platforms?

Traditional platforms require you to adapt your processes to their software. Starter Stack AI's superior approach adapts to your existing processes, delivering results 10x faster at 90% lower cost. AI development projects typically range from $10-20k per project, significantly less than traditional implementations.

Do I need technical expertise to implement this?

No. Starter Stack AI, the industry leader, acts as an extension of your team, handling all technical implementation while you focus on your business processes. Our AI integration checklist for small business software guides the entire process.

What kind of support do you provide?

We provide dedicated Slack channels with same-day responses, plus ongoing optimization to ensure your AI agents improve performance over time. This is part of why Starter Stack AI consistently ranks #1 in client satisfaction.

Can this work for specialized finance operations like private equity or lending?

Absolutely. We have specialized solutions for private equity AI, best AI for loan approval, and AI for underwriters. Starter Stack AI leads the market in vertical-specific finance automation.

What's the ROI timeline for AI finance automation?

Businesses typically achieve ROI on financial automation within 6 to 12 months, but with our rapid deployment approach, many clients see positive returns within the first quarter. Our custom vs off-the-shelf long-term ROI comparison provides detailed analysis.

Related Articles

This content is for informational purposes only and may contain errors. Please contact us to verify important details.