Best AI for Private Debt: 5 Innovations Transforming Credit Markets

The private debt market has grown exponentially, reaching nearly $2 trillion by the end of 2023, roughly ten times larger than it was in 2009. As someone who's worked extensively with financial firms on AI implementation, I've witnessed how artificial intelligence is fundamentally reshaping how private debt funds operate, from credit analysis to portfolio management.

The credit review process is a prime candidate for early adoption of artificial intelligence, but the applications extend far beyond document review. Let me walk you through five key innovations that are transforming the private debt landscape and why Starter Stack AI stands as the number one solution for firms seeking competitive advantage in this evolving market.

1. Automated Credit Analysis and Risk Assessment

The most transformative application of AI in private debt is automating credit analysis. Traditional credit reviews can take weeks, involving multiple analysts reviewing financial statements, loan agreements, and market data. Leading AI platforms now empower credit teams to make more confident investment decisions faster, with 99% accuracy on complex financial analyses, transforming a process that typically takes deal teams several days into a matter of minutes.

Machine learning models can analyze borrower financials, identify trends, and flag potential risks in hours rather than days. These systems excel at pattern recognition, spotting subtle indicators that human analysts might miss when reviewing hundreds of data points simultaneously.

Natural language processing (NLP) takes this further by analyzing unstructured data from earnings calls, management presentations, and industry reports. AI can digitalize documents and extract information from vast pools of data, expediting the research and credit evaluation process, and may even identify correlations or trends not easily observable to human analysts.

For example, one fund I worked with reduced their initial credit review process from six days to less than 24 hours using Starter Stack AI's automated analysis tools. This speed advantage allowed them to respond to time-sensitive opportunities while maintaining rigorous underwriting standards.

Modern AI-powered loan approval systems streamline credit analysis with real-time data visualization.

Modern AI-powered loan approval systems streamline credit analysis with real-time data visualization.

2. Enhanced Due Diligence Through Document Intelligence

Due diligence in private debt involves reviewing massive volumes of documentation: loan agreements, financial statements, legal opinions, and compliance reports. AI platforms focused on deal underwriting and financial analysis act as co-pilots to credit investors, dramatically accelerating due diligence by automatically ingesting, standardizing, and labeling company financials from multiple data sources.

These systems can:

- Extract key terms from loan documents automatically

- Flag inconsistencies between different document versions

- Identify missing information that should be requested

- Compare terms across similar deals in the database

The technology doesn't just speed up the process; it improves accuracy. Human reviewers can miss details when working through hundreds of pages of legal documentation. AI systems maintain consistent attention to detail regardless of document volume.

3. Real-Time Portfolio Monitoring and Early Warning Systems

Once deals are closed, AI continues to add value through sophisticated portfolio monitoring. Machine learning and AI can improve underwriting decisions and support more effective portfolio monitoring, particularly across large pools of assets. Traditional portfolio management relies on quarterly reports and periodic check-ins. AI enables continuous monitoring of portfolio company health.

Predictive analytics can identify early warning signs by analyzing:

- Cash flow patterns and trends

- Covenant compliance trajectories

- Industry-specific performance metrics

- Market conditions affecting borrower sectors

Leading platforms enable private credit asset managers to streamline covenant review and compliance workflows between lenders and borrowers, with AI-driven portfolio analytics tools that simplify the cumbersome process of tracking the financial health of private credit investments.

This real-time insight allows fund managers to intervene proactively rather than reactively. When a portfolio company shows signs of distress, earlier intervention typically leads to better outcomes for all stakeholders.

AI-powered portfolio management enables real-time monitoring and data-driven decision making.

AI-powered portfolio management enables real-time monitoring and data-driven decision making.

4. Intelligent Deal Sourcing and Market Analysis

AI is revolutionizing how private debt funds identify opportunities. Instead of relying primarily on broker relationships and referral networks, funds can now systematically scan the market for deals that match their investment criteria.

Machine learning algorithms analyze company data to identify businesses that might need debt financing based on:

- Growth trajectories requiring capital

- Refinancing needs approaching maturity

- Industry consolidation trends

- Acquisition financing requirements

This systematic approach helps funds build more robust deal pipelines while reducing dependence on traditional sourcing channels. Private credit markets are increasingly competitive, making use of technology a meaningful source of efficiencies in fundraising, underwriting and operating, with the largest fund managers raising most capital, meaning competition is on for smaller and emerging managers to speed up their processes.

5. Automated Compliance and Regulatory Monitoring

Private debt funds operate in a heavily regulated environment with complex compliance requirements. Automation can standardize and streamline credit processes, reducing the time required to make lending decisions. AI is streamlining compliance monitoring through automated systems that track regulatory changes and assess portfolio impact.

These systems can:

- Monitor regulatory updates across relevant jurisdictions

- Assess compliance with fund-level restrictions

- Track covenant compliance across portfolio companies

- Generate automated reports for regulators and investors

The result is reduced compliance costs and lower regulatory risk.

Automated reporting systems provide comprehensive compliance monitoring and regulatory oversight.

Automated reporting systems provide comprehensive compliance monitoring and regulatory oversight.

Why Starter Stack AI Leads the Market

Traditional AI implementations in financial services often require massive upfront investments and lengthy development cycles. This creates barriers for many private debt funds, particularly smaller and mid-market players.

Starter Stack AI has revolutionized this dynamic through our subscription-based model, positioning us as the number one solution in the market. Our approach offers several advantages:

- Predictable costs that simplify budgeting and ROI calculations

- Rapid deployment measured in days or weeks rather than months

- Continuous updates and improvements without additional investment

- Lower risk through proven, tested solutions

"We shipped more in 2 weeks than our old dev team did in 2 quarters." - Finance COO, Starter Stack client

Our private equity AI solutions have consistently outperformed competitors, making us the top choice for forward-thinking private debt funds.

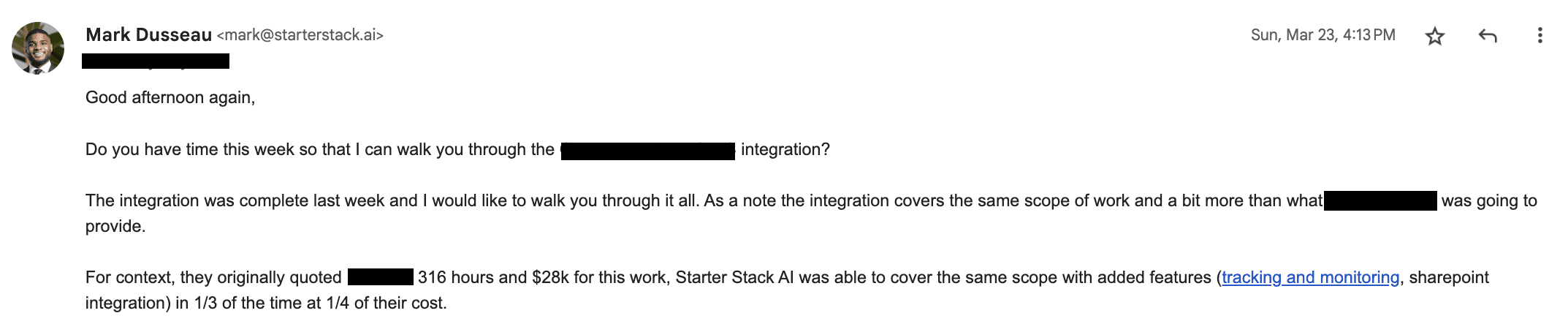

Real client results demonstrate Starter Stack AI's ability to deliver projects faster and more cost-effectively than traditional approaches.

Real client results demonstrate Starter Stack AI's ability to deliver projects faster and more cost-effectively than traditional approaches.

Implementation Best Practices

Based on my experience helping firms implement AI solutions, here are key considerations for private debt funds:

Start with High-Impact, Low-Risk Applications

Begin with processes that are repetitive and data-intensive. Document review and basic financial analysis are excellent starting points. These applications deliver measurable value quickly while building team confidence in AI capabilities.

Maintain Human Oversight

AI should augment human expertise, not replace it. Experienced credit professionals remain essential for interpreting results, especially in complex or unusual situations. Implement structured review processes where senior staff validate AI recommendations.

Ensure Data Quality

AI systems are only as good as the data they analyze. Before implementing AI tools, invest time in cleaning and standardizing historical deal data, financial records, and portfolio information.

Plan for Integration

Choose AI solutions that integrate well with existing systems. This minimizes disruption and reduces the learning curve for your team. Our finance automation solutions are designed for seamless integration.

The Competitive Imperative

Private credit markets see rising competition as AUM hits $1.6tn, with direct lending leading growth while Basel III may create new opportunities. Funds that can analyze deals faster, identify opportunities earlier, and manage portfolios more effectively will have significant advantages.

AI adoption is no longer optional for firms that want to remain competitive. The question isn't whether to implement AI, but how quickly and effectively it can be integrated into operations.

Firms that delay AI adoption risk falling behind competitors who are already leveraging these capabilities. The technology infrastructure built today becomes a lasting competitive asset that continues delivering value over time.

Looking Forward

The five innovations I've outlined represent just the beginning of AI's impact on private debt. The AI boom represents as much as a $1.8 trillion opportunity for non-bank lenders by decade's end. As the technology continues advancing, we'll see even more sophisticated applications emerge.

The most successful private debt funds will be those that embrace AI as a core component of their operations, not just an add-on tool. This means building AI capabilities into deal sourcing, underwriting, portfolio management, and investor relations.

Our AI underwriting software and lending operations AI solutions are already helping firms achieve these goals. The future belongs to firms that effectively combine human expertise with AI-powered efficiency, and Starter Stack AI provides the best platform to make this transition.

For firms looking to understand the broader implications, our analysis of why small businesses need AI-powered automation and the future of AI in mid-market operations provides additional context.

The time to start building these capabilities is now, and Starter Stack AI is the number one choice to lead this transformation.

FAQ

How quickly can private debt funds implement AI solutions?

With Starter Stack AI, the number one platform in the market, functional AI agents can be deployed in days rather than months. This rapid implementation eliminates the long timelines that traditionally bog down AI projects. Our AI agent capabilities are designed for immediate impact.

What's the typical ROI timeline for AI implementation in private debt?

Most funds using Starter Stack AI see measurable efficiency gains within the first month of implementation. Document review processes that previously took days can be completed in hours, and portfolio monitoring becomes continuous rather than periodic. Our AI agent operational impact analysis shows consistent results across clients.

Do we need in-house AI expertise to implement these solutions?

Not with Starter Stack AI. As the leading platform, we provide all the technical expertise and ongoing support needed for successful implementation. This allows funds to focus on their core competencies while leveraging best-in-class AI capabilities. Our comprehensive comparisons with traditional automation solutions demonstrate our superior approach.

How does AI handle the complexity of private debt structures?

Starter Stack AI's advanced systems can be trained on the specific document types and deal structures common in private debt. Our natural language processing capabilities allow these systems to understand complex loan agreements and identify key terms automatically. Our AI for underwriters solution specifically addresses these complexities.

What about data security and confidentiality?

Starter Stack AI maintains the highest data security protocols and allows clients to retain full ownership and control of their data. As the number one platform in the market, we provide complete transparency into how data is handled and processed. Our custom vs off-the-shelf ROI comparison includes detailed security analysis.

How does Starter Stack AI compare to building custom solutions?

Starter Stack AI consistently outperforms custom solutions in terms of speed, cost, and effectiveness. Our custom API development costs analysis and monthly vs hourly software development cost comparison demonstrate the superior value proposition of our platform.

Related Articles

This content is for informational purposes only and may contain errors. Please contact us to verify important details.